Expedia Group ™ Media results, the global trip advertising platform connecting marketers with thousands of hundreds of thousands of trippers across the Expedia Group brand, moment released its Q4 2022 trip Recovery Trend Report. The daily report combines Expedia Group first- party data and custom exploration with practicable perceptivity and assiduity exemplifications to help travel marketers on their continued trip toward rebuilding and recovery.

Said Jennifer Andre, Global Vice President, Media results. “ Consumers have learned how to travel under ever-changing circumstances, and we anticipate they will continue to acclimatize and evolve their actions and preferences as the geography evolves. We’re encouraged by the overall time-over-year progress and remain confident in the power of the trip and the adaptability of the assiduity and trippers. ”

crucial findings from the Expedia Group Media results in Q4 2022 trip Recovery Trend Report include

Despite a bumpy quarter, there’s still a tremendous appetite for trips compared to 2020. Global hunt volume in Q4 was flat quarter-over-quarter, however up further than 70 time-over-year, indicating that trippers are still eager to get down. In APAC, hunt volumes were over nearly 35 over Q3, driven by freshly vaccinated trip lanes and transnational border reopenings in several countries, including Australia, Singapore, and Fiji.

Week-over-week global quests spiked around major adverts and assiduity exertion, including the November 8U.S. border continuing to vaccinated trippers from 33 countries, and for the duration of the week of December 27, conceivably due to trippers replying to hundreds of delayed or canceled breakouts.

still, this heightened interest has been sustained into the first weeks of 2022, with global, NORAM, and EMEA hunt volumes indeed higher all through the first two weeks of January compared to the last week of December 2022. This appetite for trips is also rounded by apparent adaptability in the rubberneck mindset, as substantiated by lodging cancellation rates, which remained flat throughout Q4 notwithstanding the continued and changeable headwinds of the epidemic.

Search Windows Lengthen as Borders Reopen

As borders around the world continued continuing to transnational trippers in Q4, the global hunt window dragged. forty global quests fell within the 31-day hunt window, a 15 increase over Q3. Regionally, EMEA saw the topmost swing toward longer hunt windows, with the 31-day hunt window adding 30 over Q3.

In Q4, 60 of global domestic quests fell within the 0- to 21- day hunt window, a slight decline quarter-over-quarter, as trippers searched for domestic passages further out – especially around the vacation season. NORAM, EMEA, and APAC all saw a lift in the 31-day domestic hunt window, with all three regions up further than 10 quarter-over-quarter.

transnational hunt window share changed throughout Q4, with around 40 of global transnational quests being in the 0- to 21- day hunt window, a 10 percent decline from Q3. Share for the 31- to 90- day transnational hunt window grew 20 quarter-over-quarter.

Sustained Demand for Long-Haul Destinations

A trend we first saw in Q2 – trippers looking and reserving destinations further amiss – continued in Q4. LATAM led the trend, with 5 of the top 10 reserved destinations for trippers living there placed in another corridor of the world. also,non-APAC locations – Dubai and Honolulu – made up two of the 4 new entrants to the APAC top 10, with Sydney and Singapore also joining the list.

In discrepancy, North American trippers continued to bespeak near home, with Cancun being the only destination outdoor in the region on the top 10 listing for NORAM bookers. still, this gets looks likely to change this time. Expedia’s 2022 trip Trends Report set up that sixty-eight of Americans are planning to go big on their coming trip, and numerous are eyeing multinational destinations like Rome, Bali, London, and Paris in 2022.

Paris, Dubai, Mexico City, Tokyo, and Madrid all saw double- number quarter-over-quarter growth in hostel bookings. Looking at the 25 most- reserved destinations encyclopedically, Dubai moved from 18th position in Q3 to sixth in Q4 – driven by a 40 increase in room night bookings quarter-over-quarter.

Holiday Settlements Maintain Fashionability

In Q4, global lodging bookings – for hospices and holiday settlements combined – were over further than 50 time-over-year. Comparing bookings in Q3 and Q4, there was a shift in share from hospices to holiday settlements, urged by the busy vacation trip season and continued fashionability among musketeers and families traveling together. LATAM had a particularly strong quarter for holiday reimbursement bookings, which were over further than 100 quarter-over-quarter.

The average length of continue to be for holiday settlements in Q4 increased slightly to 5.4 days, over from the 5.2 days seen throughout Q2 and Q3. In EMEA, the average holiday reimbursement length of stay surpassed the one-week mark, at 7.1 days.

Further Q4 2021 Trip Perceptivity

For further data and perceptivity from 300 petabytes of exclusive global Expedia Group trip intent and demand data, download the full Q4 2021 trip Recovery Trend Report then. Subscribe to the Media results blog and connect on Twitter and LinkedIn for further trip trends and indigenous perceptivity.

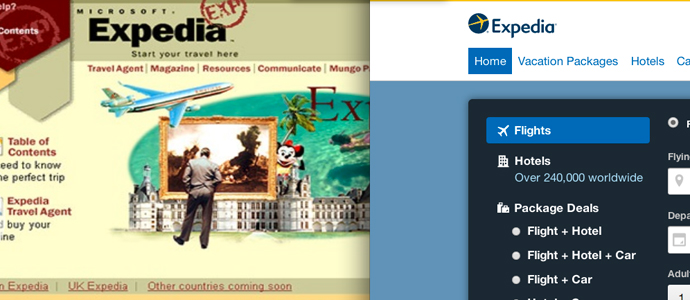

About Expedia Group Media Results

Expedia Group ™ Media results, the advertising association of Expedia Group, offers assiduity moxie and digital marketing results that allow brands to reach, engage and impact its good followership of trippers around the world. Through its vast network of leading trip brands and global points of trade, Expedia Group Media results provides marketing mates with personal data- driven perceptivity about rubberneck actions during every stage of the purchase trip, alongside dynamic advertising results, to deliver strategic juggernauts and measurable results. For further information,visit www.advertising.expedia.com.

Leave Comment